(678) 999-8212

support@oxygenbuilder.com

How a Minister Escaped the Trap of Persistent Credit Card Debt

That quote came from a minister back in 2019, reaching out to us at Churches Mutual with a plea for help. At first, it sounded like a case of predatory lending - but the real source of stress was far more common and insidious: a high-street credit card.

Over the years, the card had been used for essential life events - two house moves and the arrival of a second child. The plan was always to pay it off quickly. But as life became more expensive and repayments harder to manage, the balance grew - along with the credit limit.

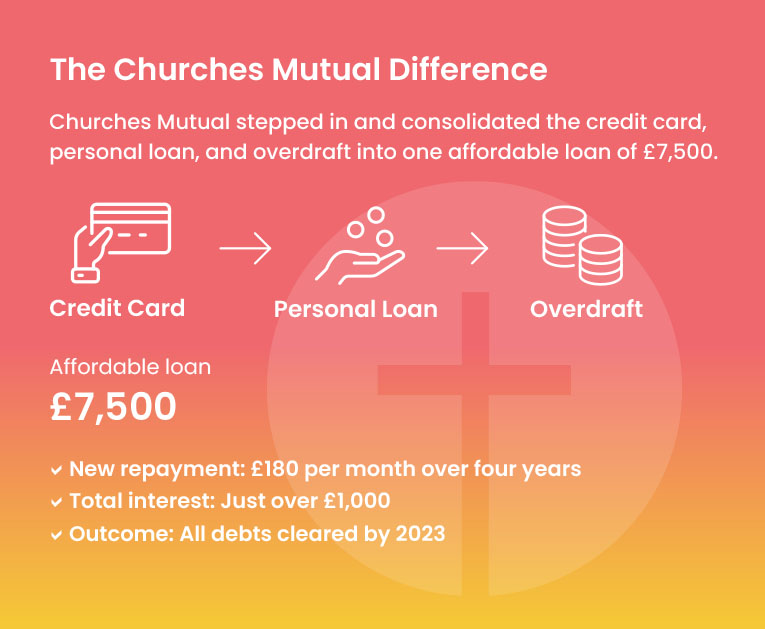

By the time he contacted us, the card had a balance of £2,950, just shy of its £3,000 limit, with an APR of 18.2%. On top of this, he had a £3,500 personal loan and a £1,000 overdraft costing £2.20 per day.

The minister and his wife had created a budget. They’d committed to paying £100 per month towards the credit card. But there was a problem: the minimum payment required by the lender was £146.

That meant:

Even worse, because their budget was so tight, they often had to use the available £30 on the card again - for essentials like fuel and groceries. It was a vicious cycle.

“If we could manage not to use the card, it would still take around £9,000 and almost eight years to clear it.”

And that was with an 18.2% interest rate - which, at the time, was below average. Today, average credit card rates have climbed to 26.72% (March 2025).

Without intervention, this family could still be battling credit card interest today - and the emotional toll that comes with it.

Need to Break Free from Unmanageable Debt?

You're not alone - and you're not without options. If you're facing persistent debt or high interest that’s holding you back, we may be able to help.

Explore ethical debt consolidation with Churches Mutual today

For General Enquiries please fill

in the form below. Or call us

on 01452 903 945

"*" indicates required fields

(Closed Weekends and Bank Holidays)

Copyright © 2026 Churches Mutual. All Rights Reserved.